After prolific levels of M&A activity in 2021 and current economic conditions and geopolitical factors, the slowdown in activity for 2022 has some sounding the alarm bells, but that may be a slight overreaction. As hot as the market was in 2021, there was bound to be a correction, and we look at the current market conditions as an opportunity to re-evaluate M&A strategy rather than go silent. In the future, 2022 could be remembered as the year that disruptors capitalized upon, while others were more tentative and missed opportunities.

2021 recap

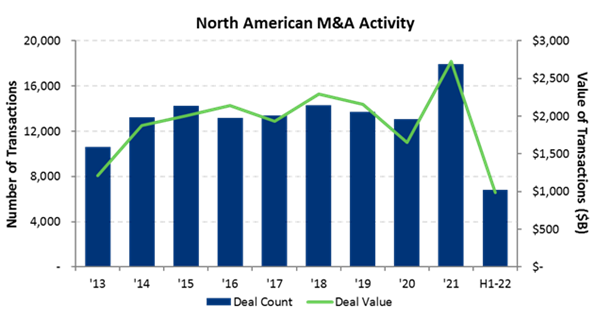

Fiscal year 2021 saw record-breaking M&A activity punctuated by 10-year highs in both transaction value and volume. Deal levels experienced a major boost, especially in H1 from SPAC-induced activity, driven by increased media attention and investor speculation in the space. Taking a look at the activity numbers from the last 10 years, it is easy to see that 2021 was a major outlier with a perfect storm of advantageous conditions swelling activity to unprecedented levels and skewing sentiment for the 2022 outlook.

Activity in H1-2022

Activity in H1-2022 is up when compared to the average of the last M&A cycle, despite challenging conditions. Buyers and sellers have become more cautious due to uncertainty surrounding global economic factors such as: rising inflation and borrowing rates, volatility in commodity costs, world-wide supply chain shortages, and geopolitical tension. Despite the uncertainty and caution from buyers and sellers, the M&A market should not be interpreted as weak.

Outlook for H2-2022

The overall outlook for the remainder of 2022 remains optimistic, with opportunity abound for those with disciplined capital allocation strategies. We believe the amount of available capital between corporations and private equity (PE) funds signals that both will continue to assess opportunities and execute capital allocation strategies to find solutions for challenges brought on by today’s economic landscape, leading to a sustainable level of M&A activity and value.

- Private equity ended 2021 with ~$827 billion in uninvested capital. Within the first half of 2022, private equity raised an additional $176 billion in cash, which is set to break record levels if the current rate continues.

- Cash and cash equivalents for S&P 500 companies at the end of 2021 totaled $3.7 trillion.

Sectors driving M&A activity

The need for digital transformation will continue to drive M&A as companies navigate the economic landscape and seek solutions for supply chain disruptions and other economic headwinds. Technology, media, and telecommunications (TMT) accounted for one-third of H1-2022 deal value followed by Financial Services (FS) accounting for one-quarter, driven by the need for digital adaptation of new technologies and capabilities to remain competitive.

Be proactive to fuel current and future growth

If you are considering an acquisition or an exit as 2022 comes to a close, consider consulting the experienced M&A professionals of UHY Corporate Finance. Whether it’s formulating a refreshed M&A strategy, discussing a potential liquidity event, or other buy-side and sell-side advisory, our dedicated and innovative specialists can help you capture value in uncertain times.

Have a Question?

Fill out the form to speak with one of our experienced Corporate Finance professionals

By submitting this form, you agree to be contacted by UHY.