The results are in! The 2023 Middle Market Trends Report polled over 250 executives across the public and private middle market to identify key performance successes, challenges and priorities businesses may experience throughout 2023.

Key findings in this year’s report include:

Middle market shows resilience but believes 2023 will upend current growth

Despite ongoing recovery fears throughout the business world, 72 percent of middle market executives say they have at least returned to pre-pandemic economic footing at the beginning of 2023 – 44 percent of which said they have “exceeded” growth expectations. That said, only 29 percent believe they will see “aggressive growth” in 2023, while 31 percent said they are hoping to maintain their current level. 40 percent plan on reining in their growth plans and taking a more “cautious” approach.

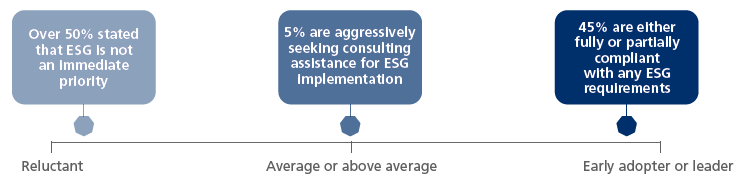

Most middle market companies are not ESG compliant

Per the study’s findings, only 45 percent of respondents said that their businesses were either “fully or partially compliant with any ESG requirements.” Additionally, only 5 percent of respondents say they are “aggressively seeking consulting assistance for ESG implementation,” while 50 percent of respondents said that they did not view ESG as “an immediate priority.” When asked what the biggest barriers to ESG implementation were, respondents cited cost (29 percent), consensus of relevant stakeholders (22 percent), and the complexity of the ESG risk management process (11 percent) as the biggest hurdles.

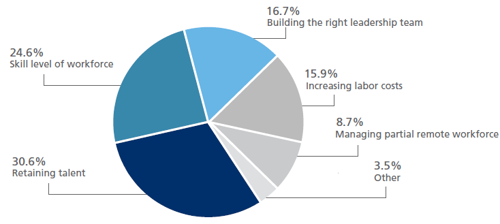

Turnover continues to plague the middle market

According to the study’s findings, when asked what the biggest workforce challenges are that they are facing, 30 percent of respondents said that retaining talent was their biggest hurdle. This was followed by the “skill level of workforce” (25 percent) and “building the right leadership team” (17 percent).

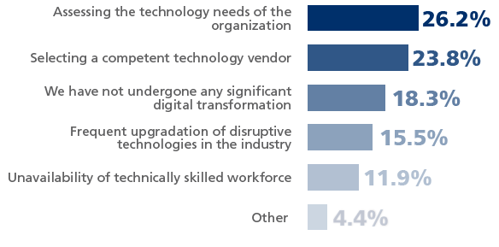

Digital transformation remains a foremost priority

Per the study’s results, organizations are still facing significant challenges in relation to achieving digital transformation success. In particular, when asked what their top digital transformation challenges were, assessing technology needs of the organization (26 percent), selecting a competent technology vendor (24 percent) and having to frequently upgrade to more sophisticated technology (15 percent), were the leading reasons cited by respondents. In addition, 18 percent of respondents said that they haven’t undergone any significant digital transformation efforts at all.

Read coverage of our report in these publications:

- CPA Practice Advisor, "72% of Middle Market Businesses Back to Pre-Pandemic Performance but Brace for Recession"

- Accounting Today, "On the move: FICPA cuts ribbon on new HQ"

- Bloomberg Law, "ESG Bottoms 2023 Priorities for Mid-Sized Businesses: Report"

- Fortune, "Readers recommend the best books to raise your CFO leadership skills"

Have a question?

Fill out the form to submit feedback or speak with one of our professionals

By submitting this form, you agree to be contacted by UHY.