2021 was a record year for U.S. M&A, with many business owners achieving exits at highly attractive valuations in a market characterized by an aggressive, well-funded, competitive buyer universe and a highly supportive lending environment fueled by low interest rates. Throughout 2022, however, the economic landscape faced a multitude of headwinds, including (i) the ongoing conflict in Ukraine and negative developments in China, (ii) market and macroeconomic aftershocks from the pandemic in the form of supply chain issues and 40-year highs in inflation, and (iii) the U.S. Federal Reserve continuing along the path of higher interest rates following its 7th consecutive rate hike in December 2022 (with a strong signal of more to come in the year ahead).

For business owners plugged into CNBC and pouring through the Wall Street Journal, it may appear that they have missed the opportunity to sell their company in a strong M&A market with healthy M&A deal volume and attractive valuations. “And we have heard this first-hand,” says Jeremy Falendysz, Partner and Managing Director with UHY Corporate Finance. “Over the past several months, a number of prospective sellers have expressed frustration that they ‘missed their window to sell at an attractive value’ or they ‘now have to wait a year or two to pursue an exit.’” This is certainly an understandable perspective given the sobering headlines in the financial press recently. While the market has been working through a number of significant challenges in 2022 and certain sectors are indeed more challenged than others, UHY Corporate Finance seeks to share some interesting observations that suggest the current M&A market may actually be stronger than many middle-market business owners believe. In many cases, the market remains open for highly attractive sale transactions for prospective sellers today.

Deal volume perspectives: But isn’t U.S. M&A down 40% in 2022?

While much attention has been paid to headlines indicating that U.S. M&A activity is down ~40% (from a total deal value perspective), this data-point sounds a lot worse than it actually is for middle-market business owners. While UHY Corporate Finance’s data corroborates the 41% decline in U.S. M&A deal value from Dealogic’s Investment Banking Scorecard at December 26, 2022, some interesting insights can be gained by taking a look beneath the surface.

Not only did the record level of M&A activity in 2021 benefit from a generally strong market, but the level of activity in 2021 was also artificially inflated as (i) a lot of deals which should have closed in 2020 were pushed into 2021 because of pandemic-related delays and (ii) many deals which would have otherwise closed in 2022 were pulled forward into late 2021 as sellers sought to avoid potential 2022 tax legislation risks. UHY Corporate Finance itself closed three deals on Dec. 31st, 2021, alone, most of which would have normally been 2022 closings in the normal course. “2021 M&A activity was truly artificially inflated, making it a challenging comp for 2022,” says Falendysz. “We would have expected to see a 20%+ decline in 2022 deal activity even without the market headwinds we are seeing today or, said another way, the headline 40% decline in U.S. M&A activity is a misleading figure in assessing the health of the U.S. M&A market in 2022.” In fact, the story is quite a bit more positive for middle-market business owners contemplating a potential sale. “This is the part we think a lot of prospective middle-market sellers are not aware of,” says Scott Merritt, a member of UHY Corporate Finance. “As UHY Corporate Finance looks at the data from a deal volume perspective, or the actual number of deals closed, we see that middle-market deal volume is actually performing quite a bit better than the broader market.”

While perceptions of U.S. M&A activity are often formed by viewing overall market activity, the fact is, the vast majority of deal volume consists of smaller, private company transactions, and not the $10+ billion dollar deals we read about in the financial press. To illustrate this point, UHY’s data indicates that deal activity for companies with $1+ billion of annual revenue has declined 52% through mid-December 2022 (vs. the same period in 2021), while middle-market deal activity saw a milder decline of only 18%. This suggests that large-cap and public deals are the ones meeting the most resistance in the current market. Large, multi-billion-dollar transactions with significant external financing requirements face a much less receptive and higher cost lending environment today. “The difference in the middle-market being that smaller, private companies are typically acquired by larger strategics with easier access to funds at more attractive interest rates via their current revolver and/or middle-market Private Equity funds with relationship lenders to lean on,” explains Merritt.

In summary, U.S. middle-market M&A volume through mid-December 2022 is only down ~18%, and when one considers that this number is similarly impacted by a challenging 2021 comp, the middle-market M&A market remains healthy, active, and accessible to prospective sellers. “Not only do we continue to see our sale transaction pipeline grow for early 2023 launches, but we have also been engaged to kick off more acquisition search processes in the new year, suggesting deal volume appears healthy heading into 2023,” states Wiley Lane, a member of UHY Corporate Finance.

Deal value perspectives: But isn’t the S&P 500 down ~20% in 2022?

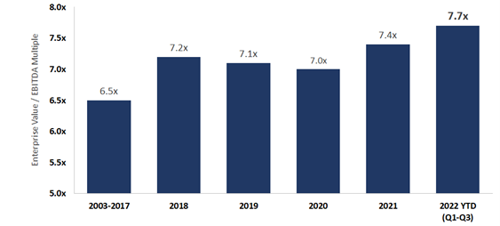

As buyers often reference public equity market valuations to ascribe values to private companies, there typically exists a close correlation between public equity market performance and private company valuations. As such, it makes sense that middle-market business owners believe they missed their window to sell at an attractive value given the S&P 500 is down ~20% in 2022 to date. However, general middle-market M&A valuations have actually increased throughout 2022, reaching all-time highs in Q3 2022. As illustrated in the GF Data presented in Figure 1 below, middle-market valuation multiples have increased from 7.4x EBITDA in 2021 to 7.7x through Q3 2022 (the most recent data available). “We think many professionals in the investment banking community are even surprised by this data,” says Lane. “Perhaps even more surprising, and encouraging, is that in addition to the multiple expansion observed throughout 2022, deals completed in Q3 actually hit peak values, averaging 8.1x EBITDA in the quarter.”

FIGURE 1: Middle-Market Enterprise Value / EBITDA Multiples By Year

Of course, this data represents valuations across deal sizes in the middle-market (from $10MM to $250MM of enterprise value) and industries, and not all industries have performed the same. For instance, while Real Estate Services valuations are down meaningfully, along with technology companies (multiples down ~1.0x EBITDA on average in 2022 vs. 2021 levels), a number of other sectors continue to see strong valuations in today’s market. While health care and food and beverage companies have seen a 0.5x+ average uptick in values in 2022, manufacturing and business services are up on average ~0.25x. “What this data suggests is that, while not all industries have navigated the challenges of 2022 as well, the window for an attractive exit for middle-market business owners may actually be wide open for many core sectors of the economy,” explains Lane. Further, GF Data suggests that companies generating EBITDA in the $5MM – $8MM range have seen more multiple expansion (increasing ~0.75x on average) than larger, middle-market companies, again suggesting that smaller, privately held companies with arguably less financing requirements are seeing the most durability in terms of transaction volume and valuations in this environment.

Conclusions

Despite the negative broader M&A market and macroeconomic headlines (including fears of an imminent recession voiced throughout much of H2 2022), (i) middle-market M&A remains active, (ii) buyers continue to pay attractive valuations to sellers of middle-market companies, and (iii) the market window to sell remains wide open and attractive in many market segments today. “Based on what we are seeing on deals currently in market and the development of our 2023 pipeline, we are not seeing a significant drop-off in activity or valuations,” says Falendysz. “UHY Corporate Finance’s pipeline remains strong looking into H1 2023 on both the sell-/and buy-side.”

Of course, continuing to monitor market trends and developments in the months ahead will remain critical for business owners targeting a liquidity event in 2023. While current market data suggests that the M&A market remains accessible to prospective sellers, there are potential market headwinds worth monitoring, not least of which are the potential effects from the Federal Reserve’s aggressive tightening throughout 2022, which appears to be on track to continue well into 2023. “Given most economists suggest that the full impact of rate hikes typically takes 6-9 months to fully materialize in the U.S. economy, we may only be experiencing the market impact of the initial hikes in March and May 2022, before the Fed commenced 75 basis point hikes beginning in June 2022,” says Merritt. As such, sellers and their advisors will need to remain plugged into real-time M&A market data and remain flexible relative to timing their market entry.

For more information on current trends in U.S. middle-market M&A, or to learn more about what a sale process and prospective value for your company may look like in today’s market, reach out to a member of UHY Corporate Finance today.

Have a question?

Fill out the form to speak with our corporate finance team

By submitting this form, you agree to be contacted by UHY.