UHY partners with LMC Automotive, an analytics/data firm that provides market intelligence and analysis to clients around the world. Their latest North American Light Vehicle Production Forecast shared insights into the state of our economy now and in the next 6-12 months.

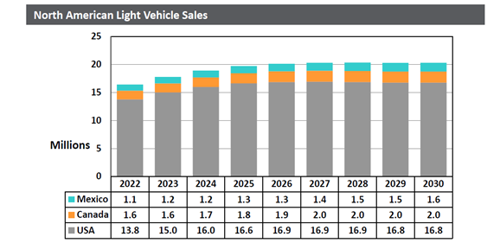

The forecast for 2023 is set at fifteen million units sold in the U.S., indicating we are operating at compressed volumes due to continued supply chain and chip shortages. However, as we look into the future, production volumes are projected to increase to just shy of seventeen million units.

Other key economic takeaways form the Q1 report includes:

- Pull back in consumer spending, but strong Q1 momentum pushes recession into Q3: Experts are expecting a recession to begin in Q3 of 2023 (originally thought to be Q2). With this expectation, Oxford Economics is predicting gross domestic product (GDP) growth of 0.9% in 2023.

- Two more rate hikes in May and June: After an increase of twenty-five basis points in March, Oxford Economics believes there will be two similar-sized rate hikes in May and June despite trouble in the banking sector.

- Recession will be brief and mild, unemployment increases: GDP will fall from 0.9% in 2023 to 0.6% in 2024 as the effects of the recession are absorbed. Unemployment is forecasted to reach 4.1% towards the end of 2023 and as high as 5.2% in 2024.

- Inflation begins to slowly fall: Core personal consumption expenditure index (PCE) inflation rose 4.7% year-over-year in February. Data shows that actual inflation exceeded estimates toward the end of 2022, but inflation is expected to moderate to 4.2% in 2023, down from 5% in 2022. The target rate for PCE inflation is 2% for reference.

- Jobs still being added despite talks of recession: January saw the addition of 150,000 jobs and fell steeply to 22,000 in February. The optimistic outlook is that jobs are still being added albeit at a much lower rate.

United States medium- and long-term outlook

Supportive fundamentals from Oxford Economics indicate that long-term potential growth output will settle around 1.5% by 2030. Factors considered include competitive wage costs underpinning stable growth and relative unit labor costs once record-high inflation and massive wage gains pass. Household debt‐to‐income ratio for U.S. households should fall back close to its long‐term average. Growth is expected to be under 2% by 2028 and beyond.

More details and insight into light vehicle production can be found within the full North American Light Vehicle Production Forecast.

Real-time data creates informed decisions

Leveraging the data from LMC Automotive and other sources, our team utilizes this information to assist you in navigating demanding situations. Our automotive team has experienced multiple market scenarios and can offer advice on how to position your business for longevity and performance.

Have a Question?

Fill out the form to speak with our automotive practice

By submitting this form, you agree to be contacted by UHY.