Overall spending in the construction industry is down for 2024, but one sector is providing room for optimism. The largest private segment, manufacturing construction has jumped more than 17 percent over the past twelve months from new federal data.

Despite the expectation that interest rates will remain elevated, the ongoing investment in industrial facilities as well as significant infrastructure related outlays will keep nonresidential spending elevated. Over the past two years an unprecedented increase in manufacturing construction spending has pushed overall nonresidential activity up to 31.9 percent higher.

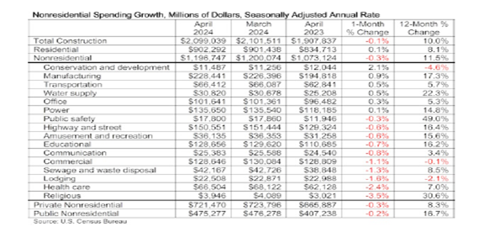

According to the U.S. Census of Bureau, nonresidential construction spending remains strong compared to a year ago. Public nonresidential spending has soared to a 16.7 percent increase over the past twelve months and private nonresidential spending has increased 8.3 percent in the same time period. Even with the increase in private nonresidential spending, the private sector has produced mixed results over the past few months.

The private sector reported a 0.2 percent decline in March and then a 0.3 percent decline in April after having several months of continued growth. With a consecutive two-month private sector the seasonally adjusted annual rate of spending to 1.2 trillion dollars, according to Associated Builders and Contractors’ analysis of U.S. Census Bureau data.

Manufacturing construction carries private sector

The sector’s overall growth is due to manufacturing construction, which is the largest private segment in the construction industry. Manufacturing construction gained 0.9 percent in April and more than 17 percent over the past twelve months. Even with this increase in the private sector of the construction industry, commercial construction fell 1.1 percent in April and is virtually unchanged from a year ago.

Ken Simonson, chief economist for the Associated General Contractors of America said, “overall spending slipped despite upturns in manufacturing and power construction.” Simonson continued “most public segments continued a seesaw pattern, with decreases in April following gains in other recent months.”

According to the Census Bureau, ten of the sixteen nonresidential categories posed a monthly decrease in April. Construction spending on lodging and healthcare projects have reported a decrease in spending for April by 1.6 percent and 2.4 percent, respectively. Following manufacturing, spending on transportation and water supply have increased 0.5 percent in April.

Despite the decline across many sectors, the country’s manufacturing construction boom continues to support overall spending levels, keeping nonresidential spending up 11.5 percent over the past twelve months according to the report provided by the U.S. Census Bureau.

By submitting this form, you agree to be contacted by UHY.