Audit & Assurance

Satisfy Reporting Obligations, Create Value and Mitigate Risks

A well-planned and executed audit and assurance process helps businesses create value and mitigate risk. We provide essential insights into the current state of your business and help you to envision and plan a stronger future for your organization. Our professionals work collaboratively to understand the challenges facing our clients, their industries, and changing business risks. UHY LLP provides a wide range of audit and assurance services, including financial audit, compliance audit, reviews, compilations, agreed-upon procedures, and other attestations.

UHY LLP is PCAOB-registered and a proud member of the Center for Audit Quality and the AICPA Private Companies Practice Section. We stand committed to enhancing investor confidence and public trust in the capital markets we serve and those who rely on the high-quality performance of independent auditors. UHY LLP is a member of UHY International, one of the world’s largest accounting networks, which gives us access to resources to address complex technical issues for our clients around the globe.

Where We Can Help

Agreed Upon Procedures

Assess specific areas of concern or interest for your organization with Agreed Upon Procedures and receive a report on factual findings without the full scope of an audit.

Compilation and Review

Substantially less in scope than an audit, compilation and review engagements can provide your organization with a baseline level of assurance over your financial statements.

Our auditors will apply analytical procedures to your financial data and make inquiries of management. We can then help you prepare your financial statements and express baseline assurance there are no material modifications needed to make those statements conform to your chosen reporting framework.

Address your organization’s compliance requirements for employee benefit plans with auditors that deliver quality attest services and valuable guidance to plan sponsors.

Financial Statement Audits

Navigate the complexities of financial reporting with professionals experienced in auditing standards generally accepted in the U.S., the AICPA, and the PCAOB.

Our highly skilled professionals conduct audits of consolidated financial statements for a variety of companies and business entities. We analyze your financial operations and communicate our findings for improvement to strengthen your activities and control objectives.

Public Company Audits

With tight regulatory deadlines and high levels of SEC scrutiny, public companies need a reliable auditor that can deliver quality, efficient work on schedule.

As a PCAOB-registered accounting firm, our professionals are well-versed in auditing public companies under PCAOB standards, performing dozens of audits every year with a deep technical knowledge of U.S. GAAP, SEC reporting, and IFRS reporting requirements.

Single Audit

Single audits are crucial regulatory requirements that allow government and not-for-profit entities to continue receiving and utilizing their federal grants and awards.

Our Uniform Guidance (single audit) and grant agreement compliance audits take a value-added approach that meets regulatory standards and provides organizational insights. We assess your organization’s internal controls environment against program standards and offer recommendations for efficiency.

In today's digital landscape, ensuring the security and reliability of your systems is critical. A SOC (System and Organization Controls) report is a comprehensive examination that assures your clients and stakeholders that your systems are secure, your data is protected, and your processes are reliable.

The SOC report process involves the examination of your internal controls, where factors like data integrity, security protocols, and operational efficiency are assessed. We can help you by identifying control gaps and vulnerabilities, recommending enhancements, and providing assurance that your organization meets SOC standards.

Agreed Upon Procedures

Assess specific areas of concern or interest for your organization with Agreed Upon Procedures and receive a report on factual findings without the full scope of an audit.

Compilation and Review

Substantially less in scope than an audit, compilation and review engagements can provide your organization with a baseline level of assurance over your financial statements.

Our auditors will apply analytical procedures to your financial data and make inquiries of management. We can then help you prepare your financial statements and express baseline assurance there are no material modifications needed to make those statements conform to your chosen reporting framework.

Address your organization’s compliance requirements for employee benefit plans with auditors that deliver quality attest services and valuable guidance to plan sponsors.

Financial Statement Audits

Navigate the complexities of financial reporting with professionals experienced in auditing standards generally accepted in the U.S., the AICPA, and the PCAOB.

Our highly skilled professionals conduct audits of consolidated financial statements for a variety of companies and business entities. We analyze your financial operations and communicate our findings for improvement to strengthen your activities and control objectives.

Public Company Audits

With tight regulatory deadlines and high levels of SEC scrutiny, public companies need a reliable auditor that can deliver quality, efficient work on schedule.

As a PCAOB-registered accounting firm, our professionals are well-versed in auditing public companies under PCAOB standards, performing dozens of audits every year with a deep technical knowledge of U.S. GAAP, SEC reporting, and IFRS reporting requirements.

Single Audit

Single audits are crucial regulatory requirements that allow government and not-for-profit entities to continue receiving and utilizing their federal grants and awards.

Our Uniform Guidance (single audit) and grant agreement compliance audits take a value-added approach that meets regulatory standards and provides organizational insights. We assess your organization’s internal controls environment against program standards and offer recommendations for efficiency.

In today's digital landscape, ensuring the security and reliability of your systems is critical. A SOC (System and Organization Controls) report is a comprehensive examination that assures your clients and stakeholders that your systems are secure, your data is protected, and your processes are reliable.

The SOC report process involves the examination of your internal controls, where factors like data integrity, security protocols, and operational efficiency are assessed. We can help you by identifying control gaps and vulnerabilities, recommending enhancements, and providing assurance that your organization meets SOC standards.

Related Insights

02/13/26

After nearly 20 years advising public and private companies, Ro Sokhi has seen just about all there is to see in the world…

12/18/25

What to watch out for—and how to prepare for new demands: ‘As banks increase digital transactions, IT and cybersecurity controls are increasingly scrutinized,…

11/24/25

The accounting profession is entering a new era of oversight.

11/20/25

Each year, our Middle Market Survey concentrates on the most pressing issues for middle market executives as they look ahead into the coming…

11/07/25

After two years of restrictive monetary policy, it seems that interest rates are trending down, potentially even further as the year draws to…

09/05/25

UHY is proud to announce that Sarah Beckman, Senior Audit and Assurance Manager in UHY's Iowa office, has been appointed to serve as…

08/08/25

UHY is proud to be ranked #14 (#18 in 2024) on the 2025 Construction Executive Magazine’s Top 50 Construction Accounting Firms list.

07/30/25

This webinar will highlight how you can prepare and maintain a comprehensive ESG strategy in response to evolving global reporting and assurance standards.

07/30/25

Every year, INSIDE Public Accounting ranks the top 500 CPA firms in the nation based on net revenue, from the multi-billion-dollar Big 4…

06/13/25

CPI is a structured, ongoing approach to identifying and eliminating inefficiencies in operations.

03/24/25

Audit pros share their memories of the early days of SOX.

02/25/25

As organizations continue to outsource more processes to third parties, companies have sought new ways to understand the controls in place at potential…

01/23/25

UHY announced the opening of its new office in Richmond, Virginia, further expanding its presence in the Mid-Atlantic region.

01/20/25

Inflation, the end of pandemic relief, and falling donations have hit nonprofits hard.

11/07/24

The Governmental Accounting Standards Board (GASB) continues to issue new accounting standards with seemingly no end in sight.

11/03/24

A new unit within the IRS’ Large Business and International (LB&I) division dedicated to large or complex pass-through entities began work on October…

08/27/24

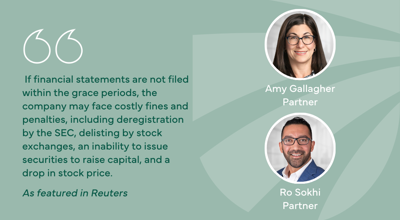

The number of public companies filing their Form 10-K late has increased about 40% over 2023, but Partner Ro Sokhi and Managing Director…

08/12/24

Forming an environmental, social, and governance (ESG) strategy can be a resource intensive task given all the areas that it could impact.

08/08/24

More and more public companies are filing extensions with the SEC for their financial reports, and professionals are raising red flags over the…

08/02/24

Missing required 10-K and 10-Q filing deadlines with the Securities and Exchange Commission (SEC) can be a costly mistake for public companies, according…

07/02/24

The Financial Accounting Standards Board changed lease accounting forever when they implemented the ASC 842 new lease accounting standard.

06/11/24

The initial deadline to complete an audit for Form 5500 Annual Return/Report of Employee Benefit Plan is quickly approaching on July 31, 2024,…

04/09/24

On April 4, 2024, the Office of Management and Budget (OMB) shared a significant update to Uniform Administrative Requirements, Cost Principles, and Audit…

02/01/24

The Corporate Transparency Act (CTA), signed into law on Jan.

03/16/23

FASB Issues Proposal that Will Boost Disclosures around Income Taxes Companies Pay in U.S., Overseas

The latest changes proposed by the Financial Accounting Standards Board (FASB) would implement a new set of income tax disclosure rules that would…

12/08/22

The Financial Accounting Standards Board issued a proposed accounting standards update (ASU) that would change some provisions of ASC 842 applicable to arrangements…

11/02/22

We’ve all heard the acronym ESG (Environmental, Social, and Governance); but what does it mean to you and your business? ESG is best…

10/10/22

The Financial Accounting Standards Board (FASB) approved an (optional) 2-year extension, until December 31, 2024, for temporary relief of transitioning away from the…

09/16/22

What is the new lease accounting standard? ASC-842, the new lease accounting standard, has been in effect for private companies with fiscal years ending…

07/18/22

In March 2022, the SEC proposed a rule to enhance and standardize climate-related disclosures for investors.

01/20/22

ASC 842, the new lease accounting standard, is effective for private companies for periods beginning after December 15, 2021.

Contact Us

By submitting this form, you agree to be contacted by UHY.