UHY’s 2023 Manufacturing Outlook was hosted live at the Donald Danforth Plant Science Center in St. Louis and live-streamed for nationwide audiences. Here is a summary of the key themes explored during the event.

The manufacturing industry faces a wide range of external pressures impacting growth, production, and overall success of manufacturing companies. Those that embrace disruption and take advantage of the evolution of the industry will position their businesses for future success.

Opportunities abound via government incentives

The 2023 UHY Middle Market Survey reported that 39.5% of businesses stated that organic growth and new business models were a key focus for their business, which points to capturing opportunities. Along with the extreme pressures previously mentioned, manufacturers have many opportunities, some of which will be available through government incentives.

For example, the Inflation Reduction Act allocates $370 billion to manufacturers toward advancing clean energy production, increasing domestic capacity and production, and other strategies. The CHIPS Act gives $280 billion to increasing domestic semiconductor manufacturing capacity and accelerating R&D to advance the commercialization of technology.

Economic outlook: Impact of government incentives not yet felt; growth expected once near-term headwinds resolve

Supply chain obstacles still exist, but market conditions vary by industry. It is difficult to get an accurate picture of the economy's performance with so many factors to consider.

The impact of major legislation has not quite been felt in the industry yet, but once those dollars are allocated, you should expect to see increases across the industry.

From a macro view, global manufacturing is down. Nineteen major countries have manufacturing sectors that are contracting, including the U.S. and Canada, based on Purchasing Managers’ Index data. The challenges on a global stage, particularly the recessions across most of Europe, should be good news for manufacturers in the U.S., allowing backlogs to be cleared and supply chains to remain intact.

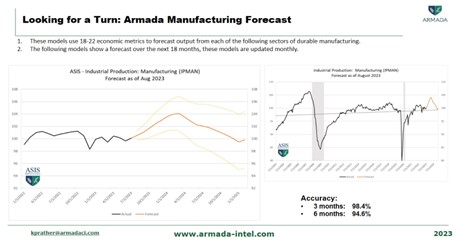

Data from Armada Corporate Intelligence forecasts a surge in manufacturing through Q2 of 2024 and more of a softening of that production through the end of 2024. The lull will stop short of a recession, but demand will cool off.

Driving bottom-line performance lies in planning, understanding, and reimagining

Driving cash flow and bottom-line performance may not be found in the more obvious areas of a business that you might think. Items like inventory management, capital expenditures, process improvement and many others will significantly impact cashflows and bottom-line performance. There are also opportunities in less obvious areas.

Planning and preparation is critical. How prepared was your business for a supply chain crisis or other challenge? Robust planning and development of contingency plans play a significant role in improving the bottom line. Revenue planning, sales and operations planning, procurement, integration of supply chain, and value streams are all areas that companies should examine.

An intimate understanding and attention to detail in your business and its core processes is one of the most critical factors in improving the bottom line. Without an understanding of your business, it becomes challenging to assess your needs and deploy appropriate solutions, and in some cases, ROI is negative and your company is losing money.

Reimagining and a renewed vision for your business will present new opportunities in the future. The image and structure of manufacturers have shifted exponentially, and your leadership team needs to be open to embracing the modern workplace and adapting to current trends. Leaving behind a “top-down” mindset for a “bottom-up” mindset will empower your workforce to make decisions, improve job satisfaction, and ultimately show up in your bottom line. Companies that remain stubborn and committed to their way of doing things risk being left behind.

Reshoring: Major opportunity and protection against the majority of geopolitical risks and others

Bringing manufacturing back to the U.S. has been a common theme over the last three to five years. From 2017 under the Trump administration to today under President Biden, legislation and policy have been geared toward improving domestic manufacturing and production. Since 2010, reshoring and FDI job announcements have gone from 6,000 annually to nearly 350,000.

Offshore suppliers may pose risks to your supply chain and your business. For decades, price was the main driver of imports, moving most of the manufacturing work offshore. Almost instantly, COVID-19 caused a shift in thinking for manufacturers. Beyond the pandemic, global tensions pose a significant risk for businesses that offshore much of their production.

Reshoring and diversifying supply chains are essentially insurance policies against unexpected major disruptions that may occur in any of those lower-wage countries. The “China premium” has increased significantly in recent years.

Not only is reshoring an insurance policy against geopolitical risk, but manufacturing closer to your customers dramatically lowers your environmental impact. Reshoring solves multiple environmental, social, and governance concerns. Environmentally, you are generating cleaner energy, cutting transportation and disposal, and producing fewer goods but with higher value. Socially, labor standards are upheld, you support the middle class, and workplace safety regulations are much higher. Governance concerns can be largely eliminated by aligning all stakeholder interests more efficiently and eliminating corruption.

Examining the total cost of ownership will prove that reshoring and manufacturing in the U.S. is not too expensive. Wage increases and labor trends in China result in a higher price to import over the product lifecycle than if you are making products here in the U.S.

Going forward, manufacturers should consider all the other factors in play to make decisions on their manufacturing presence outside of price. There are many opportunities for manufacturers through reshoring, they just need to rethink how they view cost.