ARPA Funding

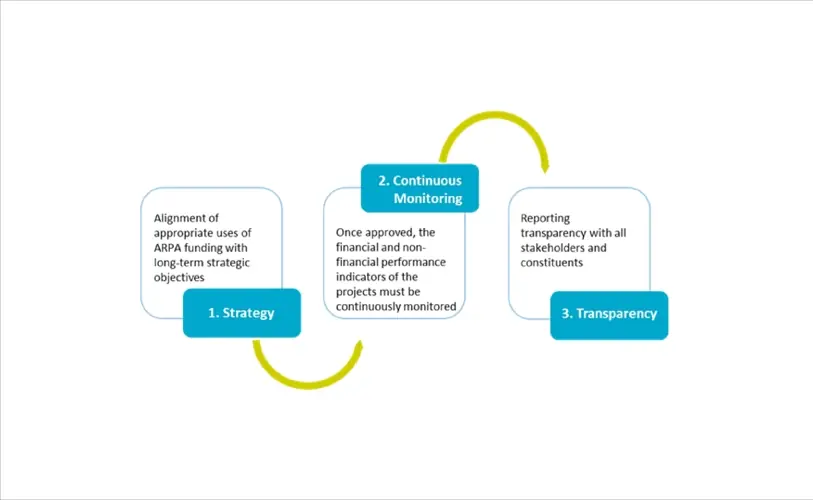

ARPA Three-Step Approach

We believe governments can significantly benefit from grouping all ARPA activities into three main areas. In serving our existing ARPA clients, we have utilized this consistent approach to provide guidance, strategic plan advice, oversight, compliance, monitoring, training, and reporting. Through this approach, we guide governments on the use of ARPA funds that best suit their constituents’ needs.

Guidance Through an Effective ARPA Disbursement

Accountants must lead the way in managing organizational ARPA risks and addressing the high expectations of transparency and integrity by establishing a strong culture of monitoring — developing policies to govern the nature and extent of monitoring procedures and subsequently training all relevant parties, such as staff, leadership teams, and the recipients and issuers of the funding. There are four major steps governments need to take:

- Gather needed information upfront to facilitate project setup: The Treasury requires a significant amount of data to be reported to monitor the use of these relief funds. If you don’t gather this information initially, you may not be able to get it subsequently.

- Establish separate cost centers: In addition to ensuring the appropriate data is included in the contracts, accountants should ensure a separate cost center or a similarly unique tracking mechanism, is established in the general ledger.

- Monitor continuously: Accountants must also constantly watch how these relief funds are being spent. The scrutiny on these funds — whether from the federal government, other regulatory authorities, the local government, or the public at large—will be intense.

- Report regularly: Depending on the size of the government, reports must be made to the Treasury either quarterly or annually. So there needs to be a clearly established process to gather the required information (both financial and non-financial) to be reported.

Contact Us

By submitting this form, you agree to be contacted by UHY.