Tax

Minimize Tax Liability, Innovate Your Tax Strategy

Whether business or personal, our substantial industry experience and invaluable insights empower you to take control of your taxes. We offer an array of strategic tax solutions that can help minimize tax liability in a complicated tax environment.

With resources at the state, national, and international level, our experienced tax professionals anticipate the next move to address current and ever-changing legal and regulatory requirements that may impact our clients.

What Do Our Clients Think?

Reducing the Tax Burdens of Small Businesses

I was spending too much time working in the business and not enough time working on the business, and we needed to make a change. Our UHY team is a true business partner that has been both proactive and responsive in managing our accounting and tax issues. UHY was a valued advisor helping us navigate through the Paycheck Protection Program and the TCJA to help us save as many tax dollars as possible. For a small business that doesn’t have an in-house accounting team, UHY has been an extension of our team and has allowed me to focus on running my business.

– Nate Johns, Partner, Element H

Setting Up for Success Through Leadership Collaboration

UHY has a strong understanding of our business that helps us plan for the future. As our business continues to evolve, our engagement team’s knowledge and informed thinking has helped us think strategically. UHY meets with our executive team throughout the year to review our tax planning strategies, which allows us to map out the year ahead. It is so refreshing to work with a team that is a joy to work with, and where we are all on the same page.

– Chris LaJoy, Owner, LaJoy Group, Inc.

Dependable Service that Adapts to Business Challenges

UHY has provided Sterling Corporation and The Markow Companies with outstanding service since 1995, supporting our tax planning, acquisition efforts, and both personal and corporate tax return preparation. They played a crucial role in the growth of our Sterling Office Services Division and have since become an essential partner, especially during acquisitions. Their support was invaluable during COVID, guiding us through complex challenges, and we are deeply grateful for their knowledge. We look forward to many more years of partnership with UHY.

– Dan Markow, Chief Executive Officer & President, Sterling Corporation

Specialized Tax Services

Combining value-added knowledge and expertise with our personalized attention and individualized strategies, we work directly with you to customize the most effective solutions for your business at the individual, state and local, federal, and international levels.

Our tax practice includes a diverse group of professionals, each with a unique technical skill set within different areas of tax. We can call upon industry leaders specializing in niche sectors of tax compliance, with a thorough understanding of those sectors. We can call upon industry leaders in complex tax segments like, cost segregation, research and development credits, and transfer pricing.

Start preparing for this year's taxes with our 2024/2025 tax guide.

Where We Can Help

Increase cash flow and reduce tax liability for your real estate assets by maximizing your depreciation expenses with our cost segregation specialists.

Federal Tax

Ensure your organization maximizes its tax deductions and credits with the help of our team’s deep tax specialization.

We’ll help ensure your organization maximizes tax deductions and credits and preserves capital so you can put those tax savings to work in your organization. Your dedicated team will provide all compliance-related services, including federal consolidated tax returns, state tax compliance and income tax reporting.

International Tax

Addressing the complexity of international taxation requires specialists with global resources to provide in-country services where your business operates.

Whether you’re an individual, family, or closely-held business, our integrated team of professionals develops strategies with you that manage and preserve your assets.

Identify and maximize the dollar-for-dollar R&D tax credit for your organization’s eligible activities and get support from our specialists to withstand IRS scrutiny.

Navigate the nuances of state and local taxes with our advisors, who have the knowledge to identify areas of exposure and improve your state and local tax standing.

Transfer Pricing

Transfer pricing is a crucial consideration for global companies subject to complex regulations over the pricing of controlled transactions within a multinational entity.

Establishing a sound transfer pricing strategy for your company is paramount to avoiding consequences, and it’s been named the single most important international tax issue.

Increase cash flow and reduce tax liability for your real estate assets by maximizing your depreciation expenses with our cost segregation specialists.

Federal Tax

Ensure your organization maximizes its tax deductions and credits with the help of our team’s deep tax specialization.

We’ll help ensure your organization maximizes tax deductions and credits and preserves capital so you can put those tax savings to work in your organization. Your dedicated team will provide all compliance-related services, including federal consolidated tax returns, state tax compliance and income tax reporting.

International Tax

Addressing the complexity of international taxation requires specialists with global resources to provide in-country services where your business operates.

Whether you’re an individual, family, or closely-held business, our integrated team of professionals develops strategies with you that manage and preserve your assets.

Identify and maximize the dollar-for-dollar R&D tax credit for your organization’s eligible activities and get support from our specialists to withstand IRS scrutiny.

Navigate the nuances of state and local taxes with our advisors, who have the knowledge to identify areas of exposure and improve your state and local tax standing.

Transfer Pricing

Transfer pricing is a crucial consideration for global companies subject to complex regulations over the pricing of controlled transactions within a multinational entity.

Establishing a sound transfer pricing strategy for your company is paramount to avoiding consequences, and it’s been named the single most important international tax issue.

Wealth Management Services

UHY Wealth Management was founded on the premise of bringing a unified client service model to our existing and prospective clients. By combining the resources of financial, tax and estate planning professionals, UHY Wealth Management aligns our services to meet your unique goals and objectives. We strive to exceed expectations in personal attention and individual service for our clients and their financial goals.

Related Insights

05/01/25

The latest development surrounding President Trump’s quest to bring manufacturing back to the United States comes by way of a tariff revision to…

04/21/25

Residents in eight states receive extensions on federal deadline while some have extra weeks for state returns, too.

04/09/25

The Republican-majority House of Representatives passed a budget plan that sets the table for the extension of President Donald Trump’s 2017 tax cuts.

03/28/25

The IRS added new questions to their FAQ under Income tax and ERC.

03/26/25

The final rule from FinCEN significantly narrows the scope of the Corporate Transparency Act and establishes a new deadline for those still required…

03/06/25

UHY is pleased to announce the expansion of its Towson office with the addition of a new partner and team members from MMK CPA,…

02/19/25

The United States Department of Treasury announced it will not be assessing penalties against citizens, domestic reporting companies, or their beneficial owners even…

02/03/25

Contractors face complex issues when dealing with sales and use taxes and the impact the taxes may have on the organization.

01/31/25

The Internal Revenue Service has made big strides over recent years to improve service, but rough spots remain as the agency starts processing…

01/23/25

UHY announced the opening of its new office in Richmond, Virginia, further expanding its presence in the Mid-Atlantic region.

01/21/25

The Michigan Flow-Through Entity (FTE) Tax was enacted in 2021, allowing entities classified as an S corporation or a partnership for federal tax…

01/20/25

Filing requirements under the CTA had been set to go into effect on Jan.

01/16/25

As 2025 begins, the cost-of-living increases for retirement plans and IRAs will become effective, as will new provisions from SECURE Act 2.0 and…

12/26/24

After just 3 days, the nationwide injunction has been reinstated on the enforcement of the Corporate Transparency Act (CTA).

12/20/24

From the battle against inflation to the election of a new administration and subsequent speculation about what it could mean for financial policy…

12/11/24

2025 will likely bring income taxes to the forefront of business and individual planning.

12/09/24

Governor Jeff Landry has worked with the Louisiana Legislature to approve significant tax reforms designed to stimulate economic growth in the state.

12/03/24

There are many tax strategies to consider over the course of the year, but the good news is that you still have time…

11/15/24

In today’s dynamic business environment, Financial Planning & Analysis (FP&A) is evolving beyond traditional number crunching and into a strategic function that empowers…

11/13/24

The outcome of the 2024 presidential election is likely to significantly impact taxes.

11/07/24

After releasing the inflation adjusted income tax brackets in October, the IRS has issued Notice 2024-80, 2025 Amounts Relating to Retirement Plans and…

11/01/24

Many individuals and businesses are still dealing with the aftermath of Hurricane Helene.

10/29/24

The Massachusetts Department of Revenue will launch a tax amnesty program from November 1 to December 30, 2024.

10/29/24

The Massachusetts Department of Revenue will launch a tax amnesty program from November 1 to December 30, 2024.

10/23/24

Tax bracket inflation adjustments for the past two years rose by 5.4% in 2024 and a whopping 7.1% in 2023.

10/04/24

Early voting for the 2024 election has already kicked off in some states, but voters are still seeking additional information on the candidates’…

09/10/24

The IRS has announced that it will start processing some of the pandemic-era Employee Retention Credit (ERC) claims that were halted when the…

08/22/24

The IRS has introduced a second voluntary disclosure program (VDP) for improper Employee Retention Credit (ERC) claims under Announcement 2024-30.

07/15/24

Texas Acting Governor Dan Patrick issued a disaster proclamation on July 5 that was subsequently amended on July 6, 2024, declaring a state…

07/08/24

We are halfway through the 2024 calendar year and the election rhetoric will only be ratcheted up as we draw closer to the…

06/28/24

The last few years have held a bevy of tax changes that have reshaped the finance environment for many companies.

06/12/24

A recent ruling from the U.S.

06/07/24

Sales tax nexus occurs when a business has some kind of connection to a state.

05/15/24

The Tennessee House of Representatives and Senate have approved Tennessee Governor Bill Lee’s proposed $1.9 billion franchise tax deal eliminating the franchise tax…

05/10/24

President Joe Biden signed The Inflation Reduction Act (IRA) into law on August 16, 2022.

05/06/24

The Michigan Department of Treasury has delayed the transition of the Michigan Treasury Online (MTO) electronic payment system to Paymentus due to issues…

04/18/24

IRS Notice 2024-35 eliminates 2024 required minimum distributions (RMD) for beneficiaries that would have otherwise been required to take one under the SECURE…

04/09/24

Governor Gretchen Whitmer is expected to sign new legislation approving a Michigan Research and Development Tax Credit that would provide significant tax savings…

04/08/24

The California Office of Tax Appeals (OTA) originally ruled that Microsoft could exclude 100 percent of repatriated income from their California business income…

03/29/24

Tennessee Tennessee Senate Passes $1.9 Billion Business Tax Cut, Law to Create Tax Refund for Tennessee Businesses Last fall, a coalition of businesses…

03/29/24

Companies are facing increased pressure from investors and consumer expectations as the business landscape continues to change drastically.

03/29/24

With decades of experience, UHY provides an extensive number of services for not-for-profit and educational organizations.

03/29/24

Our combination of knowledge, competencies, and experience helps us enable you to decrease or ease your tax burden, including taking advantage of tax…

03/29/24

Research and development tax credits assist companies in determining their allowable credit while backing them with proper documentation to withstand IRS scrutiny.

03/29/24

UHY’s professionals offer decades of experience and success in IT assurance and consulting, with specialized technology skills and extensive IT controls knowledge.

03/26/24

While tax preparation may seem like a mundane procedure, the prospect of an IRS audit can significantly elevate stress levels during tax season.

02/22/24

Earlier this month, several counties in Michigan were declared Federal disaster areas by the Federal Emergency Management Agency (“FEMA”) because of the severe…

02/08/24

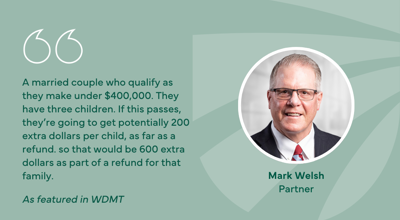

The Tax Relief for American Families and Workers Act is stalled in the Senate, but one particular provision has tax professionals keeping a…

02/05/24

As the proposed Tax Relief for American Families and Workers Act of 2024 sits in the Senate awaiting passage, some taxpayers are holding…

01/19/24

The anticipated $78 billion bipartisan deal contains benefits for both individuals and families as well as businesses.

01/16/24

The IRS issued guidance on twelve (12) provisions of the SECURE 2.0 Act on December 20, 2023.

01/09/24

As we enter 2024, many new provisions from the SECURE 2.0 Act will be effective as of January 1.

01/08/24

It's the boogeyman of tax season: IRS audits.

01/05/24

As many taxpayers are aware, the state of Michigan enacted the Flow-Through Entity (FTE) Tax effective for the tax years beginning January 1,…

01/03/24

In a significant boost to the construction industry and the green building movement, the IRS has updated its policies, providing eligible contractors with…

01/03/24

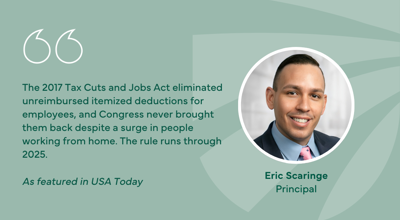

Despite the popularity of hybrid and remote working situations, taxpayers may be surprised to find they do not qualify for home office deductions…

12/28/23

As of January 1, the standard mileage rates for 2024 are as follows: 67 cents per mile driven for business use (up 1.5…

12/27/23

The Employee Retention Credit (ERC) voluntary disclosure program was announced earlier this month along with 20,000 disallowed ERC claims marking the latest in…

12/27/23

The Supreme Court case involves retirees Charles and Kathleen Moore, minority stakeholders in an Indian business classified as Controlled Foreign Corporation (CFC).

12/21/23

Year-end close processes are often a reflection of the year, and with a tumultuous one like 2023, many CFOs and controllers are looking…

12/19/23

If you bought an electric vehicle before December 31, the full EV tax credit (up to $7,500) is available on the widest selection…

12/18/23

Earlier this month, the IRS announced that it was launching a voluntary disclosure program for those who received payments on illegitimate employee retention…

12/15/23

December is not only a time to reflect on your finances and goals for the coming year, but also an opportunity to plan…

12/12/23

The Internal Revenue Service (IRS) issued IR-2023-194 on October 20, 2023, indicating the launch of new initiatives using funding from the IRS Inflation…

12/06/23

Certain provisions of the Tax Cuts & Jobs Act are set to expire at the end of 2025. These changes, along with bonus…

12/02/23

As of October 1, 2023, the IRS has raised the estimated tax underpayment penalty to 8%, a significant increase from the 3% of…

11/28/23

The IRS recently announced that it would delay the $600 reporting threshold on platforms like PayPal, eBay, Etsy, Venmo, and Cash App until…

11/16/23

Life insurance can provide peace of mind, but if your estate will be large enough that estate taxes will be a concern, it’s…

11/13/23

Several factors are making 2023 a confounding tax planning year for many.

11/10/23

If your business completes minor repairs by December 31, you can deduct those costs on your 2023 tax return.

11/08/23

The 3.8 percent net investment income tax (NIIT) is an additional tax that applies to higher-income taxpayers on top of capital gains tax…

11/07/23

The year-end is coming up, and tax planning is an essential element of maintaining a good financial balance.

11/07/23

When it comes to cybersecurity, CISOs, Executive Leaders, and Board members have a tough job.

11/06/23

Effective January 1, 2024, Brazil will adopt the Organisation for Economic Co-operation and Development (OECD) Transfer Pricing Guidelines.

11/05/23

The federal income tax brackets for 2024 released by the IRS have been adjusted with an annual inflation rate slightly above that of…

11/05/23

With electric vehicle inventories approaching 100 days' supply for certain automakers, the Department of Treasury is looking to put another jolt into EV…

11/03/23

Further cuts to the IRS’ almost $800 billion in funding from the Inflation Reduction Act are jeopardizing the newly introduced business tax accounts…

11/02/23

A highly-supported bipartisan bill to re-establish a state tax credit research and development for research spending is moving quickly through state Congress.

10/25/23

Business owners may be familiar with the rule that permits a business to deduct employee bonuses this year if the bonus is paid…

10/20/23

The IRS has introduced a significant update for business owners regarding the notorious Employee Retention Credit (ERC).

09/25/23

Inflation caused a whopping 7.1% inflation-adjusted increase in tax bracket limits for 2023, and according to a new report from Bloomberg Tax, the…

09/18/23

The employee retention credit (ERC) has been capturing headlines for most of the last few months, and employee retention credit specialists have been…

08/29/23

The controversial SECURE 2.0 Act provision requiring “catch-up contributions” for high-paid employees to be made on a Roth basis was set to take…

07/27/23

Employee retention credit (ERC) eligibility has been a hot topic for business owners recently as companies look to recoup losses suffered during COVID-19,…

07/25/23

It’s never too early to begin planning for your estate with a qualified professional in the event of your untimely passing.

07/07/23

Northwest River Supplies (NRS) is the story of a remarkable entrepreneur who founded a remarkable business.

05/23/23

Recent reports have raised new concerns about the impending insolvency of the Social Security program, absent congressional action.

05/16/23

Estate planning is a crucial aspect of personal finance that cannot be ignored, especially by business owners.

05/04/23

The Michigan Department of Treasury has amended the sales and use tax laws as they relate to the taxability of “delivery and installation”…

05/02/23

The narrow requirements for qualifying for the electric vehicle tax credits under the Inflation Reduction Act are causing some consternation in the auto…

05/02/23

As long as it’s still around, TikTok is arguably the most popular social media application currently operating.

04/26/23

The Inflation Reduction Act (IRA) extended and expanded the Section 30D Clean Vehicle (CV) Credit, previously known as the Electric Vehicle (EV) Credit.

04/24/23

After receiving $80 billion from the Inflation Reduction Act in 2022, the IRS has released a strategic plan for the allocation of those…

04/10/23

Bonus depreciation, covered under Section 168(k) of the tax code, is set to expire at a rate of 20% each year through Dec.

04/05/23

Almost a third of Americans wait until the last minute to file their taxes, most reporting it's due to a stressful or complicated…

03/01/23

A wave of new tax rules and incentives are starting in 2023 as older provisions begin expiring of scaling down.

02/14/23

Section 1332 of the Energy Policy Act of 2005 initially created the Internal Revenue Code Section 45L Tax Credit for Energy Efficient Homebuilders,…

02/13/23

Processing an amended return is still a manual process estimated at about 20 weeks for paper and e-filed amended returns, but taxpayers can…

02/03/23

The IRS recently released updated draft Form 6765 instructions, the form governed by IRC Section 41, Credit for Increasing Research Activities.

01/24/23

New parents are often equally overjoyed and overwhelmed when it comes to their first child, but unfortunately, the new child also brings new…

01/24/23

The Setting Every Community Up for Retirement Enhancement (SECURE) Act 2.0 was included as part of the Consolidated Appropriations Act, 2023 that was…

01/11/23

As of January 1, the standard mileage rates for 2023 are as follows: 66 cents per mile driven for business use (up 3…

01/06/23

Despite a low IRS audit rate historically, there is an expected increase in enforcement over the next 5-6 years due to provisions in…

12/29/22

On December 23, 2022, Congress passed the Consolidated Appropriations Act of 2023.

12/28/22

The $1.9 trillion American Rescue Plan of 2021 included a provision requiring third-party settlement organizations to issue Form 1099-K based on a much…

12/23/22

The Consolidated Appropriations Act, 2023 (CAA), created to fund the government through the fiscal year ending Sept.

12/15/22

If you or an advisor must file a Form 706 with the IRS to report estate or generation-skipping tax, understanding the IRS’ allowance…

12/05/22

Time is running out to make sure mandatory withdrawals from your retirement account(s) are made before the end of the year to avoid…

11/30/22

Standard depreciation methods require depreciating the cost of fixed assets over several years, whereas two accelerated depreciation methods “bonus depreciation” and “Section 179…

11/29/22

“The Inflation Reduction Act (IRA) will provide approximately $80 billion over 10 years to fund the IRS and improve tax enforcement activities and…

11/16/22

From the CHIPs Act to the Inflation Reduction Act, there’s no shortage of enacted and pending legislation that is impacting taxpayers.

10/27/22

Recently, the office of the Illinois State Treasurer was tasked with handling one of the most bizarre and complicated unclaimed estate cases ever…

10/26/22

Not long after releasing changes to more than 60 tax provisions for 2023 due to inflation, the IRS has issued Revenue Procedure 2022-55…

10/24/22

Inflation has infiltrated all layers of our economy including our tax system.

10/19/22

The Research and Development Tax Credit is a dollar-for-dollar cash incentive for US-based businesses that experiment and create more efficient processes and products. …

10/17/22

Recent guidance from the IRS states that it will be extending the transition period for more detailed R&D tax credit reporting requirements related…

10/14/22

When President Biden signed the Inflation Reduction Act (IRA) into law in August, most of the headlines covered the law’s climate change and…

10/10/22

The Creating Helpful Incentives to Produce Semiconductors (CHIPS) and Science Act was signed into law by President Joe Biden in August 2022, containing…

10/06/22

On October 5, 2022, Governor Parson signed into law Missouri SCS Senate Bills 3 & 5.

10/04/22

This IRS relief postpones tax filing and payment deadlines for federal individual and business tax returns with deadlines occurring beginning on September 23,…

10/03/22

The Employee Retention Credit (ERC) has been utilized by many companies as an incentive to keep employees on their payroll even as the…

08/29/22

The 1% tax on stock buybacks included in the final Inflation Reduction Act may be a nominal amount, but it may be a…

08/24/22

The Inflation Reduction Act expanded the affordability of greener vehicles in the U.S.

08/17/22

The Inflation Reduction Act includes significant provisions related to climate change, health care, and, of course, taxes.

08/11/22

The Inflation Reduction Act promises $790 billion in funding to health care and climate initiatives over the next decade.

08/09/22

With Senate passage of the Inflation Reduction Act, the legislation is expected to pass the House and go to President Biden for signature…

08/09/22

Its recent swoon aside, cryptocurrency continues to make incursions into the mainstream, with roughly 200 million people worldwide using or having used it,…

08/08/22

The Creating Helpful Incentives to Produce Semiconductors for America Act (CHIPS Act) was recently passed by Congress as part of the CHIPS and…

08/05/22

High gas prices may have declined since their peak in June, but the IRS is offering relief for business travelers who are more…

08/04/22

The Research and Development Tax Credit (R&D tax credit) is a dollar-for-dollar cash incentive for US-based businesses that experiment and create more efficient…

07/15/22

Key legislation was recently passed in Iowa, changing the filing and payment requirements for sales, use and excise taxes; the changes took effect…

06/30/22

The Colorado Department of Revenue has enacted a new fee/tax related to the retail delivery of goods into the state effective July 1,…

06/22/22

While 90,000+ families have filed for the state’s new child tax rebate, many more Connecticut families are eligible for the funds.

05/26/22

The SECURE Act became law in late 2019 and along with its changes to retirement and estate planning strategies, but it also raised…

05/09/22

Virginia joins other states who have adopted state and local tax (SALT) workarounds to the $10,000 federal deduction limit on an individual’s federal…

04/19/22

In 2019, the bipartisan Setting Every Community Up for Retirement Enhancement Act (SECURE Act) — the first significant legislation related to retirement savings…

04/12/22

It’s been two years since COVID-19 forced many employees to work from home.

03/09/22

Tax season is well under way, and Mark Welsh sat down with 47 ABC to share some of the top tax tips to keep in…

03/08/22

Research and development (R&D) tax deductions and credits have long held bipartisan political support in Congress and throughout the business and consulting world.

03/07/22

Prior to the Tax Cuts and Jobs Act (TCJA) in 2017, individuals were able to claim a deduction on their federal income tax…

02/24/22

According to our 2022 Middle Market Trends Survey 26% of respondents had not considered transfer pricing as a strategy and needed help with…

02/21/22

The Department of Treasury is administering a $409 million business grant relief program to help certain businesses that have experienced hardship due to…

02/16/22

The reduced rates were part of a $2.5 billion annual tax cut that also includes a child tax credit and increased deductions for…

02/14/22

Partner Robert Lickwar talks about the anticipated delays with the IRS, the benefits of starting earlier, and switching from paper to e-filing returns…

02/11/22

After much discussion in 2021 surrounding changes to estate planning opportunities, there were no changes made for the 2021 tax year.

02/03/22

According to the latest information from the IRS, amended Forms 941 that have already been filed should expect to see a refund somewhere…

01/26/22

With inflation at record highs, switching inventory valuation methods from first-in, first-out (FIFO) to last‐in, first‐out (LIFO) could help mitigate the effects of…

01/17/22

The arrival of tax season also brings new tax-related scams, Mark Welshsat down with 47 ABC to share some tips on how to…

01/04/22

Many Americans, led by Millennials and Gen Z, are venturing into the world of cryptocurrency trading, seeing it as a way to get…

01/04/22

According to the UHY 2022 Middle Market Trends Survey, middle market business owners say their three biggest tax challenges were understanding tax reform,…

01/03/22

On December 27, 2021, Michigan Governor Gretchen Whitmer signed legislation allowing for the deduction of certain gambling losses for tax years starting in…

Contact Us

By submitting this form, you agree to be contacted by UHY.